Cost For Order Flow Financial Glossary

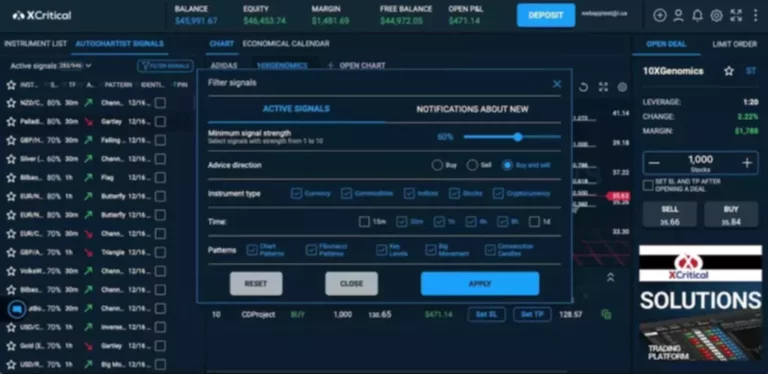

By using specialized order circulate tools, merchants can establish trading alternatives and make more informed choices about when to enter or exit trades. Also known as inventory order routing or order flow selling, PFOF is a course of whereby online brokerages depend on high-frequency buying and selling (HFT) firms to execute inventory and choice investment transactions. This means your orders aren’t being immediately sent to the stock exchanges by your broker, however by a third celebration. Since market costs rapidly fluctuate for shares, you can end up paying a worth that’s slightly larger or decrease than what you’d initially bargained for. The execution of retail trading orders has developed pfof greatly during the last 20 years.

Primary Ideas Of Trading And Demat Accounts

IIHL claimed in a press statement that the sum had been deposited and knowledgeable the CoC and NCLT. Reliance Capital owes collectors Rs 23,666 crore, principally to bondholders represented by Vistra. IIHL’s resolution plan required creditor and administrator actions post-July 29. The Delhi High Court has confirmed its earlier ruling requiring SpiceJet to ground and return three engines to lessors Team France 01 SAS and Sunbird France 02 SAS inside 15 days.

Understanding Order Dealing With In Indian Inventory Markets – A…

Some analysts say that benchmark is flawed as a end result of about 40% of buying and selling quantity, together with many individual investors’ trades, takes place exterior of exchanges. It would require broker-dealers and market makers to reveal more knowledge, together with a month-to-month abstract of worth enchancment and different statistics. Also, the retail brokers like Robin Hood and Ameritrade might not be capable of ship customer orders directly to a wholesale dealer to be executed, until they’re bettering the worth. Hopefully, this should set the tone for extra far reaching modifications to the US capital markets.

What Is Zero Dividend Most Popular Stock?

Payment for order move emerged in its current type in the Eighties, when it was championed by Bernie Madoff. Decades earlier than his conviction for masterminding an unlimited Ponzi scheme, Mr. Madoff led a firm that paid retail brokerages for orders and executed them off-exchange. Within milliseconds, Citadel Securities bought Mr. Hanson’s Immunovant stock for $5.0221 a share—an enchancment over one of the best price quoted on exchanges, where patrons have been providing $5.02 for the shares. The securities quoted within the article are exemplary and usually are not recommendatory.

In Style Market Profile Trading Setups

Proponents of fee for order flow cite gains like his 21 cents as proof the market works well for small investors. Critics say the follow has so warped the market that it’s inconceivable to say what Mr. Hanson, who works in financial companies, would have earned in a really open market. Previously, the capital market was thought-about a site of high-net-worth buyers and financial institutions. However, the capital market has turn into equally in style amongst small buyers right now.

Market microstructure refers to the mechanics of how monetary markets function. An Orderflow trader works with more information, such as location, competitors, quantity where the max trades occurred, different quantity history and so forth. Don’t worry, we’ve got you coated 👍 – We have one other providing within the name of Bracket Orders (BO). This is used whenever you wish to limit your loss and lock in the profit. For occasion, suppose you positioned a Buy SL order with a trigger price of INR 1,139.40 and a limit value of INR 1,one hundred forty.

These indicators are utilized by traders to comprehend market dynamics and make clever trading choices. Hence, order flow trading reveals a different means of market dynamics, where the main focus is on real-life transitions, and altering prices. In conclusion, this practice of buying and selling offers merchants a deep data of market emotions, unveiling the war between buyers and sellers. There are many key indicators that one ought to bear in mind while performing this buying and selling as these indicators assist an individual to get a deep knowledge of all of the elements that affect the buying and selling. One ought to know his / her type of buying and selling after which select the suitable software for them. The apply of PFOF has at all times been controversial for causes touched upon above.

One morning in September, Phil Hanson clicked a button on his TD Ameritrade screen and bought 100 shares of Immunovant Inc. However, banning PFOF may not he all that straightforward as it is a normal apply and banning could distorting the free pricing logic that’s inherent in the market. Obviously, if you want to operate and run a margin trading account, you need to be clear in regards to the necessities of margin buying and selling. There exists a number of ways in which a company can raise the required quantity of capital.

In response, the SEC launched Rule 606 (formerly Rule 11Ac1-6[27]) beneath the Securities Exchange Act of 1934, aiming to handle these issues. The rule has undergone a quantity of amendments to maintain pace with the evolving market construction, technological advancements, and buying and selling practices. Apart from a market order, there are other inventory market order varieties as well. One of the largest benefits of the market order is that an investor can get into the stock at any given time. Traders can look for indicators of exhaustion or imbalance within the order circulate information, such as excessive volume with out significant worth movement.

A individual selling at that same second would count on a value of $101.02 or better. Regulation NMS requires brokers to reveal their policies on PFOF and their financial relationships with market makers to investors. Your brokerage firm ought to inform you when you first open your account, and then replace you yearly about what it receives for sending your orders to particular parties. Regardless, that is still an astounding change over the same period during which low- or no-commission brokerages came on the scene.

Our Super App is a powerhouse of cutting-edge instruments corresponding to basket orders, GTT orders, SmartAPI, advanced charts and others that allow you to navigate capital markets like a pro. The worth at which the order might be executed is determined based on the prevailing market price. In fact, the market price could be totally different from when the order was positioned and when the order is executed by a few rupees because stock markets are volatile and stock prices change every second. So if you’re able to take your trading to the following degree and acquire a deeper understanding of market dynamics, Order Flow Trading will be the proper method for you. With the proper instruments, strategies, and best practices, you can turn info into power and construct a more successful trading profession.

- Also, the retail brokers like Robin Hood and Ameritrade could not be succesful of ship buyer orders directly to a wholesale dealer to be executed, unless they are bettering the worth.

- To increase transaction volume and enhance the standard of their information, exchanges provide rebates to brokerage firms to incentivize order move.

- A widespread contention about PFOF is that a brokerage could be routing orders to a specific market maker for its own benefit, not the investor’s.

- Derivatives like futures and options help buyers attain profits within the volatile share market.

- There have additionally been questions surrounding the accuracy of worth enchancment data, as a lot of it is compiled by the brokers themselves.

- At this age if you begin to earn you feel like spending on something and every thing, on the similar time you concentrate on having a financially secured future.

Under the PFOF, brokers (mainly the low-cost brokers) get paid to send customer stock orders to market makers. There are some ways to evaluate shares but the most typical practice adopted by merchants over time is technical analysis. This method identifies prevailing and reversal tendencies in the market and alerts merchants as well.

Regulations require that brokers fill orders at what’s referred to as the NBBO (National Best Bid and Offer) or higher. The reducing of charges has been a boon to the industry, vastly increasing access to retail traders who now pay less than they’d have beforehand. However, these benefits would disappear any time the PFOF prices prospects more by way of inferior execution than they saved in commissions.

Read more about https://www.xcritical.in/ here.