Contra Accounts: Explained, Popular Types and Examples

At this point, it isn’t known which accounts will become uncollectible so the Accounts Receivable balance isn’t adjusted. Instead, an adjusting journal entry is done to record the estimated amount of bad debt. Accumulated Depreciation is a contra asset that pairs with Fixed Assets. Accumulated Depreciation acts as a subaccount for tracking the ongoing depreciation of an asset. A Fixed Asset is a Long-term Asset used by a company to create revenue.

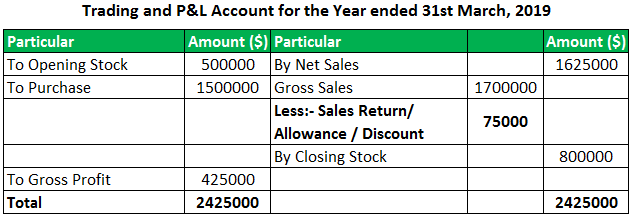

Contra Revenue Accounts

An estimate of bad debts is made to ensure the balance in the Accounts Receivable account represents the real value of the account. Allowance for Doubtful Accounts pairs with the Bad Debts Expense account when doing adjusting journal entries. A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification.

A Closer Look at Contra Revenue and Equity

- Contra equity accounts carry a debit balance and reduce equity accounts.

- The account is typically used when a company initially pays for an expense item, and is then reimbursed by a third party for some or all of this initial outlay.

- Contra asset accounts include allowance for doubtful accounts and accumulated depreciation.

- This deeper insight is particularly valuable when comparing financial performance across different periods or against industry benchmarks.

- The presence of contra expense accounts significantly influences the presentation and interpretation of financial statements.

The most common one you might encounter is treasury stock—where companies buy back their own shares. It’s essentially a reverse investment; instead of pouring money in, the company is taking it back, reflecting a decrease in shareholders’ equity. This can have various strategic implications, from attempting to increase per-share earnings to trying to prevent takeovers. Contra equity accounts, therefore, act as a ledger for corporate strategy, impacting how the worth of a company is perceived from the outside. A contra equity account is an account that is used to offset another equity account on the balance sheet. Contra equity accounts are typically used for a company to buy back its stock or shares.

Components and Usage of Contra in Accounting

For example, when a customer’s cheque bounces, a contra account steps in to reconcile the situation financially. The initial receipt and the subsequent deduction are both logged, revealing the net effect of the transaction without distorting the total income. Also, when products are returned, Sales Returns and Allowances—a type of contra revenue account—offset the previously recognized sales revenue. Such accurate record-keeping is vital for maintaining the integrity of your financial reports. Moreover, contra expense accounts play a role in enhancing the transparency of financial reporting. By clearly delineating reductions in expenses, these accounts help to avoid the potential for overstating costs.

Tools and Resources for Contra Account Management

It can help companies see the complete picture of their income and expenses and their equity or net worth. Lenders should always compare AR and AP and look for contra/offsetting dollar amounts to the same company, individual, or related entity to ensure the value of receivables we’re lending against is accurate. Without a review of contra accounts, the institution may find itself significantly under collateralized should the company default on its credit facility. By understanding the nature and function of contra accounts, businesses can accurately reflect their financial position, providing transparency to stakeholders such as investors, creditors, and internal management.

Contra Asset Accounts

CCC estimates that 5% of accounts receivable will most likely be unrecoverable. A contra account is used to show the opposite effect or reduction of a related account. The points below explain the importance of passing a contra account entry. These accounts facilitate auditing and financial analysis by providing a detailed breakdown of adjustments contra expense account examples made during a specific accounting period. This information assists auditors, and financial analysts in evaluating a company’s financial performance and risk exposure. A contra account is an account listed within a general ledger with the purpose of capturing the reduced value of a paired or related account when the two are added together.

The contra account accounting reduces the total number of outstanding shares. The treasury stock account is debited when a company buys back its shares from the open market. The presence of contra expense accounts significantly influences the presentation and interpretation of financial statements. By offsetting specific expenses, these accounts ensure that the reported figures more accurately reflect the company’s net expenditures. This adjustment is particularly important for stakeholders who rely on financial statements to make informed decisions, as it provides a clearer picture of the company’s operational efficiency and cost management.

The key example of a contra equity account is Treasury stock, which represents the amount paid to buyback stock. Companies often receive discounts from suppliers for early payment of invoices or bulk purchases. These discounts are recorded in a contra expense account, which offsets the original expense recorded for the purchase.