Preliminary Dex Offering Ido Definition

Decentralized exchanges may cost a small itemizing fee, but primarily earn revenue from the buying and selling fees that an IDO generates. Many initiatives maintain a presale or one other form of ICO prior to holding an IDO. In this case, the IDO sometimes lists the token at a better worth than what investors could purchase it for through the ICO. ICO buyers may be able to sell their tokens during the IDO to understand a profit. After ICOs faded, the Initial Exchange Offering became popular because of its lack of risk on the user’s part.

A token providing is a fundraising methodology the place a project or startup supplies a new cryptocurrency on the market. Some buyers purchase the coins for his or her utility, while others do it for speculation. For example, you would possibly use the coin for farming, staking in a governance mechanism, or paying for transaction charges. Initially, IDOs used decentralized exchanges (DEX) and sensible contracts to facilitate the switch of tokens and funds between parties.

It eventually stabilized at simply over $1, with some patrons complaining that they purchased at a better value than pre-sale traders. This, nonetheless, highlights the issue with Uniswap quite than UMA. Join our mailing record to remain within the loop with our newest news about DeFi, NFT, Infrastructure and Gaming token offerings. While some launchpads use purely monetary metrics to decide participation, others like Scaleswap’s ScaleSCORE take loyalty and involvement into consideration.

What Is Preliminary Dex Offering (ido) In Crypto?

An Initial DEX Offering (IDO) is a most popular method in crypto, providing tokens on a Decentralized Exchange (DEX). Unlike the risk-prone Initial Coin Offering (ICO), IDOs take away intermediaries. They allow investors to buy tokens at launch costs, offering liquidity through post-sale liquidity pools.

What’s An Mev Bot? A Deep Dive Into Crypto’s Silent Arbitrageurs

An preliminary dex providing (IDX) is a substitute for an preliminary coin providing (ICO). Unfortunately for builders, exchanges have charges and limit consumer investments, which isn’t best for giant investors! Also, the centralized nature of IEOs means some projects merely won’t minimize it, gate-keeping the business and its developers. You’ll now be given particular directions on the means to lock your funds in preparation for the token generation occasion.

However, their decentralized and clear nature might provide them with a better regulatory path than ICOs. ICO’s are the crypto-fied model of an Initial Public Offering (IPO) or when a non-public company presents public inventory to boost funds. You reside in two stories, however rent is dear, so that you supply a 3rd story, or “part” of your ownership, to make ends meet.

The evolution of decentralized fundraising by way of IDOs led to the creation of IDO launchpads. Currently they provide a safe, easy, and seamless way to participate in IDOs. The way ahead for cryptocurrency as a complete is away from centralization and towards decentralization, which IDO launchpads embody and promote. This is why IDOs and IDO launchpads are the future of fundraising. Initial DEX Offering (IDO) is the newest method of fundraising for cryptocurrency initiatives that takes place on a decentralized change (DEX). IDOs have turn into a significant fundraising avenue in the cryptocurrency domain, providing a decentralized, environment friendly what is ido, and accessible method for projects to secure capital.

Due diligence doesn’t assure that a token will rise in worth, however it could assist cut down on scams. Whereas an IDO requires a partnership between a crypto project’s staff and the IDO supplier, an ICO only is decided by the crypto project staff. This can create extra https://www.xcritical.com/ flexibility and allow the project to supply lower costs for its token. Once a DEX accepts a project for an IDO, the project must arrange a sensible contract. The smart contract creates a liquidity pool with the project’s tokens and units a worth for the model new token.

- This is much more fair for traders all over the world who could also be forced to buy tokens in an IDO in the center of the night time of their timezone.

- It takes place on a decentralized liquidity exchange (DEX) via the use of liquidity pools and sensible contracts.

- Introduction to the world of Initial DEX Offerings (IDO) opens a new chapter in blockchain-based project financing.

- When raising funds for a project via an IEO or ICO, projects are first required to pay exchange charges and await a project to receive approval by the exchange earlier than it’s listed.

- With any crypto project, traders are placing a lot of trust within the improvement team’s capability to ship and follow-through on a roadmap.

When it comes to fundraising, it’s necessary to have some type of control to remove token worth changes or have KYC rules, that are noted in ICOs, IEOs, and STOs. A new technique of investing in thrilling crypto startups is on the rise, and it could become the de facto mechanism for tasks to fund their improvement. Initial DEX Offerings (IDO for short) have plenty of potential, and offer a a lot better means for the common individual to take part in new crypto tasks compared to previous methods.

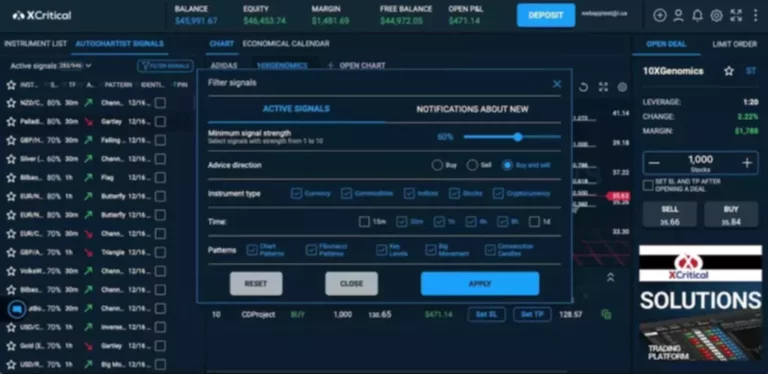

It’s necessary to do thorough research earlier than making any crypto-related investments. IDOs stand out for his or her decentralized nature, bypassing the need for centralized fundraising platforms seen in ICOs and IEOs. This decentralization permits broader participation, enabling anyone with the requisite crypto belongings and web entry to speculate. Consequently, IDOs open doorways to a extra numerous vary of buyers globally. StormTrade’s IDO on PancakeSwap centered on creating a decentralized trading platform with superior analytics and buying and selling tools. The project aims to empower traders with real-time data and insights for informed decision-making.

The main distinction is that instead of going down on a random web site, gross sales of new tokens take place on a trusted web site. In the case of an IEO, that’s a centralized crypto trade, like Binance. For IDOs, that’s a decentralized trade, such as Polkastarter. Investors have to be a member of the centralized change that’s holding the IEO in order to buy tokens.

In an ICO, a new project offers its crypto token to traders by way of mechanisms like a presale. Instead of going through an exchange, the project sells its token directly to the basic public. IDO has lots of benefits over ICO and IEO models, and it leverages the most out of blockchain know-how. However, centralized exchanges are more ubiquitous, and much more person friendly to most of the people and novice crypto traders.

The variety of tokens you get will depend on what quantity of members there are within the sale, and any extra funds staked will be returned to you. There might even be measures in place to make it fairer for small buyers to get a share of the IDO, such because the Basic Sale and Unlimited Sale features on the PancakeSwap IFO below. With any crypto project, investors are placing plenty of trust within the improvement Know your customer (KYC) team’s ability to deliver and follow-through on a roadmap.